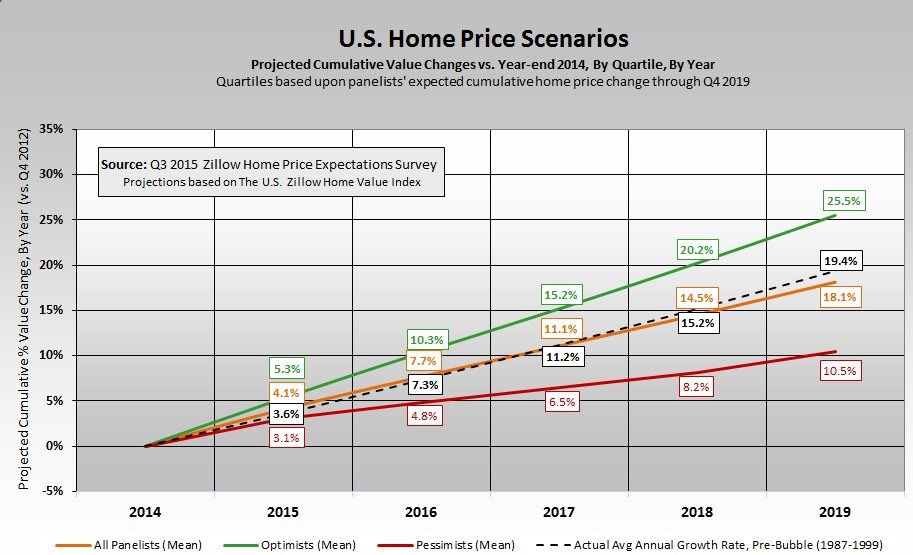

Zillow and Pulsenomics just released their third quarter 2015 Home Price Expectations Survey for the nation as a whole and the more than 100 panelists surveyed are a bit less optimistic than they were for the 2nd quarter survey in May. Their new consensus forecast is for cumulative appreciation of 18.1% over the 5 year period from 2014 to 2019. That’s down from the previous forecast of 19.2%. They also ratcheted down their 2015 forecast slightly to 4.1% from 4.3% last quarter.

Pulsenomics Founder Terry Loebs made the following observations:

The panel’s expectation for U.S. home values fell to a 3.4 percent average annual rate for the five-year forecast horizon. This is the first time in 18 months that this proxy for experts’ housing market sentiment has weakened, and it’s the lowest rate recorded in three years. With slow wage growth persisting and monetary policy liftoff looming, home price expectations may continue to drift lower for some time.

The panelists also provided their outlook for homeownership rates. Currently at 63.4%, homeownership is expected to stay flat for the next two years and ultimately rise to only 63.7% by 2020.

Outlook For Chicago Area Home Prices

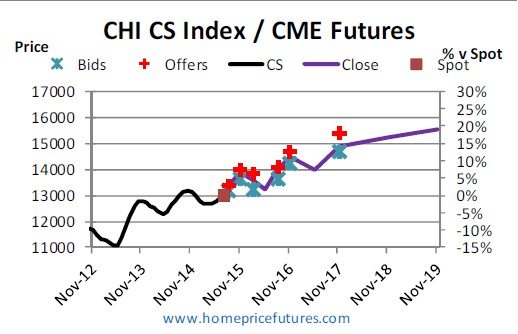

The closest thing to a home price forecast for Chicago is the admittedly thinly traded Case Shiller futures market, where people essentially place bets on the direction of home prices here. The graph below comes from John Dolan’s July recap of the Case Shiller home price futures market.

The outlook for Chicago is actually moving in the opposite direction to the rest of the nation. 3 months ago the the November 2017 contract (which actually reflects the index value for September 2017) had a midpoint of 149.5 but now it’s slightly higher at 150.2. Relative to September 2014 that is a total gain of 14.6% over the 3 year period or 4.6% per year, which is more optimistic than the national outlook from Pulsenomics which is roughly 11.1%. Keep in mind that currently Chicago is lagging most of the nation in home price gains so I guess some people think that’s going to change.

Experts Opine On Rent Control

As part of this survey they also asked the real estate experts their opinion on rent control. No surprise that “Almost two-thirds [63%] of panelists said rent control policies are ‘government intrusions into the marketplace that, however well-intentioned, always create more problems than they solve.’” And another 33% said that “rent control might be effective in a crisis, but should be a last resort”.

After the repeated failures of rent control, and command and control economies in general, is this seriously still a real debate? The panelists went on to point out what should be obvious to politicians by now:

Panelists largely cited rising rents on non rent-controlled apartments and less incentive or resources for maintenance and improvements among rent-controlled properties as the main effects of rent control policies. Three-quarters of respondents (75 percent) said they would expect rents for nearby units not subject to rent control to rise somewhat or significantly within areas where rent control policies are in effect. Almost all (92 percent) said building improvements by property owners would fall somewhat or significantly, while 85 percent said they would expect building maintenance would suffer somewhat or significantly.

#HomePrices #RealEstate #ChicagoHomePrices

Gary Lucido is the President of Lucid Realty, the Chicago area’s full service discount real estate brokerage. If you want to keep up to date on the Chicago real estate market, get an insider’s view of the seamy underbelly of the real estate industry, or you just think he’s the next Kurt Vonnegut you can Subscribe to Getting Real by Email. Please be sure to verify your email address when you receive the verification notice.