By Thursday the calls requesting showings started to come in fast and furiously. Home buyers were seeing homes for the first time with the intention of signing a contract by midnight Friday. It was hard to reach realtors who were scrambling to show homes and sign deals in a matter of hours. Clearly, anyone in the market for a new home decided to pick up the pace a bit in order to get an extra $8,000 from their neighbors before the window closed.

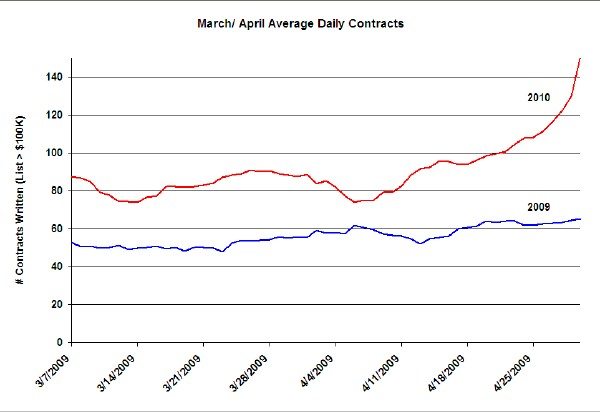

So I decided to pull the home purchase data for Chicago to see exactly how big this effect was. The result is shown in the graph below, which looks at the 7 day moving average (to eliminate the weekend dip) of home contracts signed in March and April of this year vs. last year. I limited the data to homes priced above $100K.

We all know that sales have been running above last year for some time now – perhaps because of the homebuyer tax credit; perhaps because the housing market is recovering. So I ran the data back to March to establish a baseline. As you can see, contracts to buy homes really took off in the last week of April.

Of course, the real question is what now? Is this Cash For Clunkers all over again – where sales tank after the government program ends? Will prices drop when it becomes clear that demand will dry up? Almost certainly, though the magnitude of the impact is anyone’s guess. Let’s face it. Anyone who was thinking about buying a home put it in high gear the last few months and that demand has been sucked out of the next couple of months. However, I have run into a lot of buyers over the last few months that made it very clear that, although they would like to get the credit, they weren’t going to rush into buying a home just so they could get $8,000. Many of those buyers expected prices to drop anyway after April 30. Those buyers are still out there – waiting for good deals.