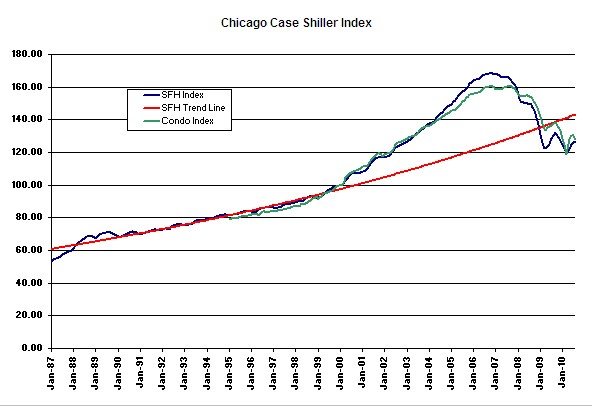

The Chicago Case Shiller home price index just came out for August and it looks like the decline is back – one month earlier than I originally predicted. Now, you may read elsewhere that home prices were actually up in Chicago and that would sort of be true but there’s more to the story. The home price index for single family homes was up a measly 0.4% from July and that’s the index that is most widely reported. However, the condomium price index was actually down – by a lot – 2%. You can see the different indices plotted below vs. the long term trend line. The green line is the condominium price index.

Single family home prices have dropped 2.9% from last year at this time and are down a total of 24.9% from the peak in September 2006. This puts us back to January 2003 levels. We’re still 11.5% below that red trend line above, which gives us some long term upward pressure in my opinion. However, the short term pressure is clearly downward with the current Chicago housing market in a sad state (if you are a seller).

By comparison, Chicago Condominium prices have dropped 7.3% in the last year – down a total of 20.6% from their peak. Condominium prices are now at November 2002 levels.

These August numbers represent sales from June – August, a period when the “benefits” of the homebuyer tax credit were just beginning to wear off. June still had positive sales comps. But wait until next month’s numbers are released. Not only will the September numbers have a tougher year over year comparison but all three months had extremely weak sales activity. We’re headed for a triple dip.