I’m certainly not trying to be a populist here but when something doesn’t make sense it really bothers me and I feel compelled to point out the absurdity (which is why I got into the real estate business but that’s another story). And when it comes to Chicago property taxes there’s a lot that doesn’t make sense – some of which I’ve dealt with in previous posts.

As I’ve written about certain high profile property sales in Chicago I’ve noticed that many of these extraordinarily expensive homes have ridiculously low property taxes. So I set off on a mission to find out if in fact there was a systematic bias in the way property taxes were assessed – and I did find a bias but it didn’t quite show the extreme under assessment that I expected to find at the very high end of the housing market.

As I pointed out in an earlier post 2012 Chicago property taxes are essentially 1.8% of what the county thinks your home is worth minus $448 if you get the homeowner’s exemption. Therefore, the only way property taxes can be too low or too high is if the estimated market value is too low or high. But there is really no way to know the true market value of a property – unless it sells because then the sales price, by definition, is the true market value.

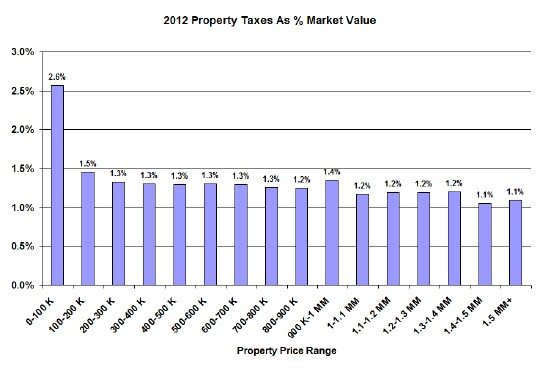

So I decided to analyze 2012 property taxes as a percentage of sale price for some recent (last 3 months) Chicago home sales and to look at those percentages by price point. And to keep it simple I only looked at homes that had the homeowner’s exemption. If the Cook County assessor’s office was doing a perfect job with their estimates of property values then the property taxes would come in right around 1.8% of the sale price, less a small adjustment for the homeowner’s exemption, which would bring that percentage down a bit – more at the low end than at the high end.

The result appears in the graph below which shows that homes sold below $100,000 on average have property taxes equal to 2.6% of their sale price. In other words, the county is over estimating their market value, which is driving up their property taxes and thereby driving up their property taxes as a percentage of the actual market value. As you go up to the next price range of $100 – 200 K the property tax rate drops to 1.5% and then 1.3% above $200K. It then seems to level out for a while until you get to $800K and then it drops down again at $1.4 MM.

In other words, people who own homes worth less than $100,000 are paying more than twice the property tax rate as homes at the upper end. For a $100,000 home this difference amounts to an extra $1400/ year tax burden (2.6% – 1.2%) x $100,000.

Why is this happening? It could be that in the poorer neighborhoods the Cook County Assessor’s office is out of touch with how far property values have fallen in the wake of the housing bubble bursting. Another (very likely) possibility is that the assessor’s office actually got it right in 2012 but since then property values have recovered more in the richer neighborhoods than the poorer neighborhoods since 2012. And keep in mind that a) the assessor’s office didn’t have this sales data when they set the property values for 2012 and b) they can’t really do anything about these discrepancies until tax year 2015. Let’s just hope that Joseph Berrios keeps an eye out for this bias when they start working on 2015.

In the meantime if you think that the assessor has your home overvalued be sure to file an appeal when the window opens for your township.

If you want to keep up to date on the Chicago real estate market, get an insider’s view of the seamy underbelly of the real estate industry, or you just think I’m the next Kurt Vonnegut you can Subscribe to Getting Real by Email:

Please be sure to verify your email address when you receive the verification notice.