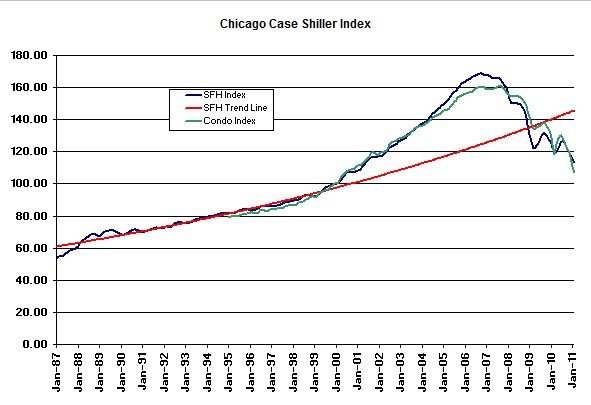

Oh the humanity! The Case Shiller home price index was just released and once again it shows further declines in Chicago home prices for February. Prices have now fallen for 6 months straight and that’s after making two failed attempts to stage a comeback since this whole housing bubble burst. Single family home prices fell 2.2% in February, while condo prices fell 3.1%. That means that the total decline since the bubble peak in late 2006 is 32.8% for single family homes and 33.3% for condos. In other words…homes have lost 1/3 of their peak value now. You can see the long term trend in the graph below.

In just the last year single family homes have lost 7.6% of their value with condos losing 13.8%. With this decline single family home prices are now back to June 2001 levels, while condo prices are now back to June 2000 levels. That puts single family home prices 22.3% below that trend line in the graph. How much further can home prices really drop? Well, if you have an opinion on that you can enter our home price forecasting contest and have a chance to win $500 shared with 2 other contestants. The contest is a consensus forecasting project and as of the time of this post the consensus is that Chicago home prices will fall an additional 2.6% by June.

For a closer look at price declines in different segments of the Chicago real estate market you can see last night’s post, which uses a different set of data from CoreLogic.

We are from Los Angeles and the San Diego area of California and it sounds like you could be telling us our fate as well. What is so sobering about the whole ordeal is just how long it’s going to take many of us just to reach a break-even again for what we paid initially.

We have a family motto, actually it’s a joke, but it goes, “Buy high, Sell Low.” Unfortunately the joke came from some realism. So our home investment is no longer about location-location-location, it’s about patience-patience-patience!