Ever since October of last year the city of Chicago has been seeing year over year increases in home sales of 27 – 70%. Everyone pretty much knew this was being largely driven by the homebuyer tax credit, which was causing buyers to purchase homes sooner than they would have otherwise – but not actually bringing new buyers into the market. Of course, the politicians were clueless about the futility of their lame efforts to manipulate the housing market but soon there will be no doubt that they failed miserably. In about 2 weeks the July sales numbers for Chicago and the surrounding area will be released by the Illinois Association of Realtors and it will show the first decline in 10 months – down about 19.5% from last year. We will be seeing additional declines over the next few months.

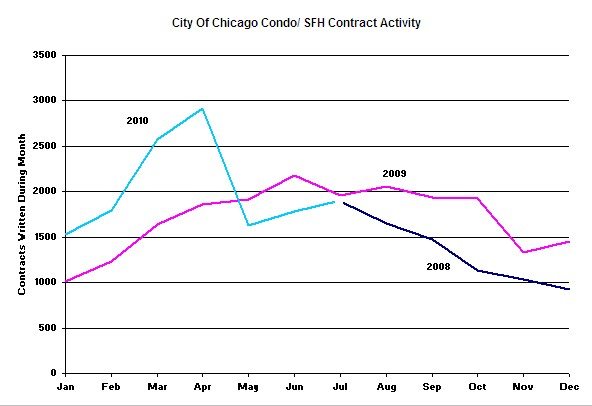

But the tax credit ended in April so why are we first seeing the impact in July? Because there is about a 1 – 2 month lag between when buyers enter into contracts and when the sales actually close and the numbers reported by various realtor groups focus on closings. As I’ve shown in the past, when you look at contract activity it’s apparent that home purchase activity fell off of a cliff as soon as the tax credit ended. Now that I have 3 months of contract activity post government meddling you can see what happened more clearly in the graph below.

This graph is a little tricky to interpret because it doesn’t contain all of 2008’s data but what it shows is that contract activity in the latter half of 2009 was up substantially over 2008 levels. Then in the early part of 2010, until the tax credit expired, contract activity was way up over the previous year, 2009. Starting in May, contract activity fell off the cliff and for the first time in a year actually fell below the previous year. This pattern has continued through July, when activity almost matched the level of 2008 (which makes the graph a bit confusing because it looks like 2010 and 2008 are part of the same line but they’re not).

It is encouraging that the July contracts were actually pretty close to 2009 levels so it will be interesting to see where August falls. However, I’m not holding my breath.