It looks like time travel is not just limited to the characters of Lost. Home prices in the Chicago area continued their fall in March, with single family home prices back to April 2002 levels and condo prices back to August 2001 levels. This is the first time we’ve turned the clock back to 2001!

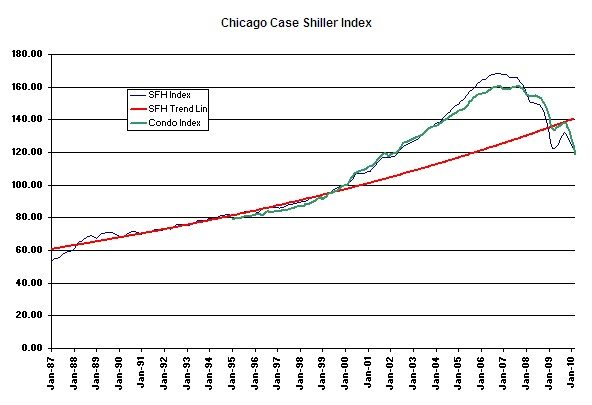

Despite what you may have read in the mainstream media yesterday about home prices rising, the Case Shiller Index was just released and it shows that home prices are continuing to fall. Single family home prices have fallen a total of 29% from the bubble peak in September 2006, while condo prices have fallen a total of 26.3% from their peak in September 2007. The graph below shows the long term history of these two indices along with a trendline that establishes more “normal” levels.

The Case Shiller index provides a much more accurate picture of home prices than the median prices often reported in the mainstream media because it actually captures price changes in the same homes over time. On the other hand, the median price just reflects the prices of whatever mix of real estate has sold during the time period in question. It could be all 1 bedroom condos one month and all McMansions the next month.

You may also read today about how single family home prices are only down 2.1% from last year but that is also deceptive. It just so happens that prices had fallen pretty fast and far at this time last year. Just wait until they’re comparing the numbers to last September after they went up a bit.