The September Case Shiller home price index just released shows Chicago home prices losing even more steam than at the last release, which is a bit surprising considering how fast properties are selling and how few properties are actually available for sale. But the story is a subtle one.

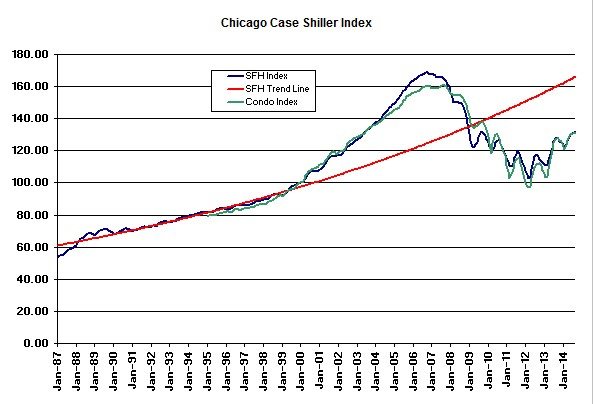

The Case Shiller Chicago home price index fell in September – both single family homes and condos declining by 0.1%, which is not a lot. Furthermore, a decline of this magnitude is not at all bad for this time of year. But when you look at the long run graph below it becomes apparent that the recent home price gains in Chicago are losing steam.

With the exception of last month single family home prices are the highest they’ve been since January 2009 and condo prices the highest since December 2009. These levels also correspond to where the Chicago housing market was back in June 2003 as the bubble was forming.

Speaking of the bubble, single family home prices have fallen a total of 22.1% from the bubble peak while condo prices have fallen a total of 18.7%. But prices have still recovered nicely from the bottom – single family home prices up 27.8% and condo prices up 34.5%.

But we’re really not making much progress lately in catching up to the long term trend line, which we are still lagging by 20.9%.

The national home price picture was pretty much the same. David M. Blitzer, Managing Director and Chairman of the Index Committee at S&P Dow Jones Indices noted that:

The overall trend in home price increases continues to slow down. The national index reported a month-over-month decrease for the first time since November 2013…The 10- and 20-City Composites continued their year-over-year downward trend, gaining 4.8% and 4.9% compared to last month’s year-over-year gains of 5.6%…Eighteen of the 20 cities reported slower annual gains compared to last month.

Other housing statistics paint a mixed to slightly positive picture. Housing starts held above one million at annual rates on gains in single family homes, sales of existing homes are gaining, builders’ sentiment is improving, foreclosures continue to be worked off and mortgage default rates are at pre-crisis levels. With the economy looking better than a year ago, the housing outlook for 2015 is stable to slightly better.

It’s the year over year picture for Chicago that concerns me the most. As you look at the graph below you can see that as each month goes by our gains over the previous year are getting smaller and smaller. Yes, it’s still positive news but single family home prices are only up 2.6% vs. last year and condo prices are only up 2.4%. Those are both lower than the long term average gains that Chicago has experienced – pre-bubble – and it’s the lowest gains we’ve had in 21 months for single family homes and 23 months for condos.

#CaseShiller #Realestate #HomePrices

If you want to keep up to date on the Chicago real estate market, get an insider’s view of the seamy underbelly of the real estate industry, or you just think I’m the next Kurt Vonnegut you can Subscribe to Getting Real by Email. Please be sure to verify your email address when you receive the verification notice.