Dow Jones S&P CoreLogic released the June Case Shiller home price indices this morning and revealed, once again, that home price appreciation in the Chicago area and across the nation keeps slowing down. Looking at the entire nation single family home prices appreciated at a mere 3.1% rate over the last year, compared to last month’s 3.3% rate. And for the top 20 metro areas that they follow the rate was only 2.1% vs. 2.4% last month.

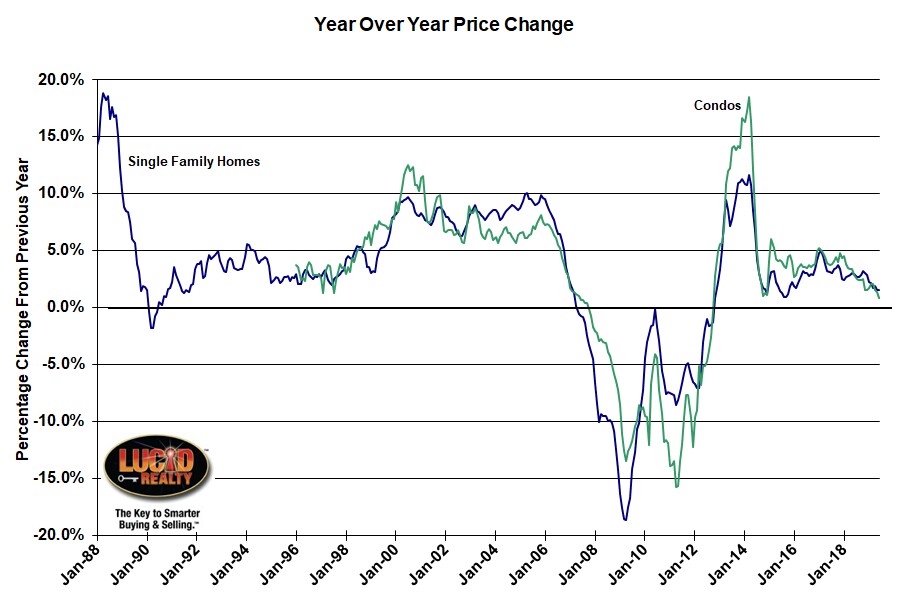

By comparison the Case Shiller Chicago single family home index credits the area with a mere 1.5% annual appreciation rate, the lowest rate in 44 months. See the graph below for the historic annual appreciation rates for both single family homes and condos. This places the Chicago area 5th from the bottom of the rankings of the top 20 metro areas that they track. We actually moved up one slot in the rankings and can now say that we are in the top 80%. Several former high flyers have fallen from grace and are now below Chicago: New York, San Francisco, San Diego, and Seattle. Seattle, surprisingly, is actually seeing falling home prices! As the Case Shiller folks point out the West Coast is dragging while the southwest and southeast are leading the nation.

Case Shiller Chicago Area Home Price Index By Month

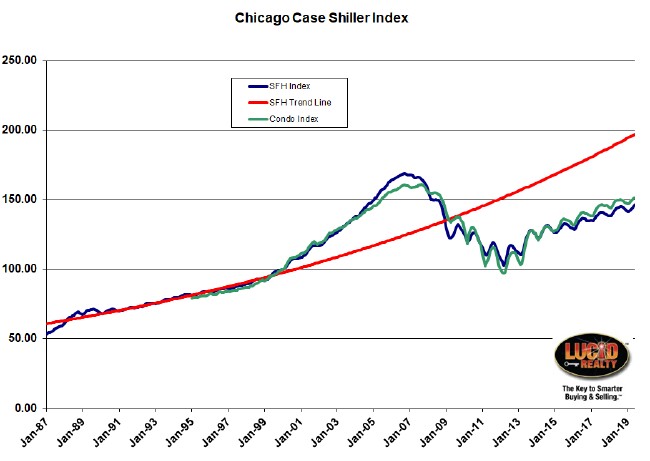

The graph below shows the historic levels of the Case Shiller Chicago area home price index for both single family homes and condos. In June the SFH index rose by 0.7% from May while the condo index was flat.

You can see several patterns in the graph below. From the bottom of the market in March 2012 (when I luckily closed on the purchase of my house) SFH prices have bounced back 42.6% and condo prices have come back 55.4%. Nevertheless, SFH prices still fall short of the peak by 13.1% and condo prices are lagging 6.1%. Those gaps are large enough that Chicago SFH prices are still below the levels they were at during the entire period from September 2004 – October 2008 and condo prices are below their July 2005 – October 2008 levels.

Even more disconcerting is the fact that home prices are not anywhere near keeping pace with their rate of appreciation prior to the housing bubble as represented by the red trendline in the graph below. Note how the green and blue lines are clearly heading in a different direction than the red line.

#CaseShiller #ChicagoHomePrices #HomePrices

Gary Lucido is the President of Lucid Realty, the Chicago area’s full service real estate brokerage that offers home buyer rebates and discount commissions. If you want to keep up to date on the Chicago real estate market or get an insider’s view of the seamy underbelly of the real estate industry you can Subscribe to Getting Real by Email using the form below. Please be sure to verify your email address when you receive the verification notice.