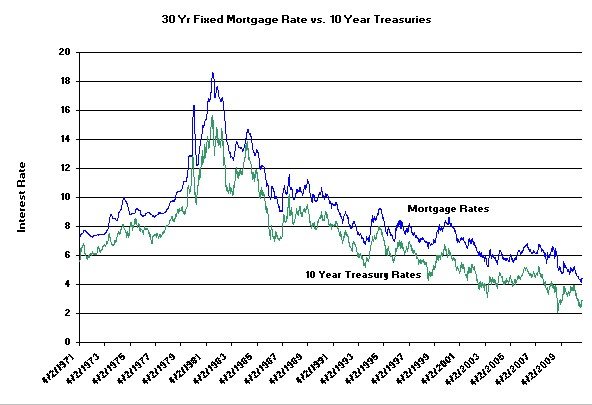

First, let’s put this in perspective. Check out the graph below which shows 40 years of history (that’s all I have) comparing 30 year fixed mortgage rates to the rate on 10 year treasuries. A couple of things stand out from this chart. First, it’s readily apparent that we are still near the lowest level in the period covered by the graph. In reality I’ve heard that this is more than a 50 year record low. Sure, rates have ticked up lately but in the grand scheme of things money is still pretty cheap. Second, it’s pretty clear that mortgage rates track 10 year treasury rates fairly closely. That’s what “they” have always said and it stands to reason. Investors can choose to buy either mortgages or treasury bonds and mortgages require some kind of risk premium, which probably won’t vary that much over time.

Of course, the real question is where do rates go from here? The government is doing all they can to keep interest rates down by buying bonds. That drives the prices up and consequently drives the yields down. But how long can they keep this up? And will they just focus on the short end of the yield curve or will they play with the longer maturities? And in the end who is stronger, the government or the market?

It’s the answer to that last question that is key. Take one guess. The fundamental problem with all this government bond buying (also known as quantitative easing) is that it’s ultimately inflationary and all the signs are currently pointing to higher inflation: a variety of commodity prices, the price of TIPS (treasury inflation protected securities), and until recently the value of the dollar. And the trick with inflation is that investors expect to be compensated for it with higher interest rates. So interest rates go up unless the government decides that they will be the only lender in the market, which I would hope is widely recognized as a bad idea.

And let’s not forget that the government keeps borrowing more and more money, which also pushes up interest rates. So if not now, sooner or later all manner of interest rates simply have to go up.