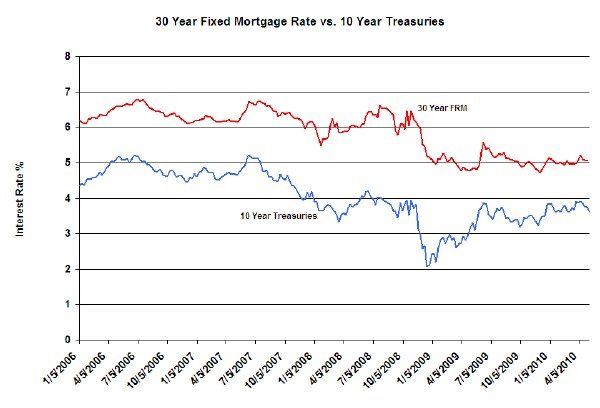

It looks like the Greeks may be inadvertently bearing gifts for the US home buyer. With the Greek debt crisis escalating there is a “flight to quality” occurring – investors are bailing on the debt of Greece and other European countries (out of fear that the crisis will spread in some way that I’m not clear about) and buying US government bonds. And this may be putting downward pressure on mortgage rates in the US.

Historically, US mortgage rates fairly closely follow the rates on US

treasuries – e.g. the 10 year government bond:

So, as investors drive up the price of treasuries, they drive down the interest rate on those bonds. Presumably this should help drive down the rates on mortgages. This week, as the Greek debt crisis balloons, the rate on 10 year treasuries has been dropping (note the dip on the far right side of the blue line) and we may see this soon reflected in lower mortgage rates.

Of course the irony in all this is that the US is seen as a safe haven despite our deficit of 10.6% of GDP, while Greece is chastised for having a 12.7% deficit vs. the European goal of 3%.

Speaking of mortgage rates, notice how they did NOT spike up when the federal reserve ended their mortgage backed security purchase program at the end of March. Of course, readers of this blog expected nothing less 🙂