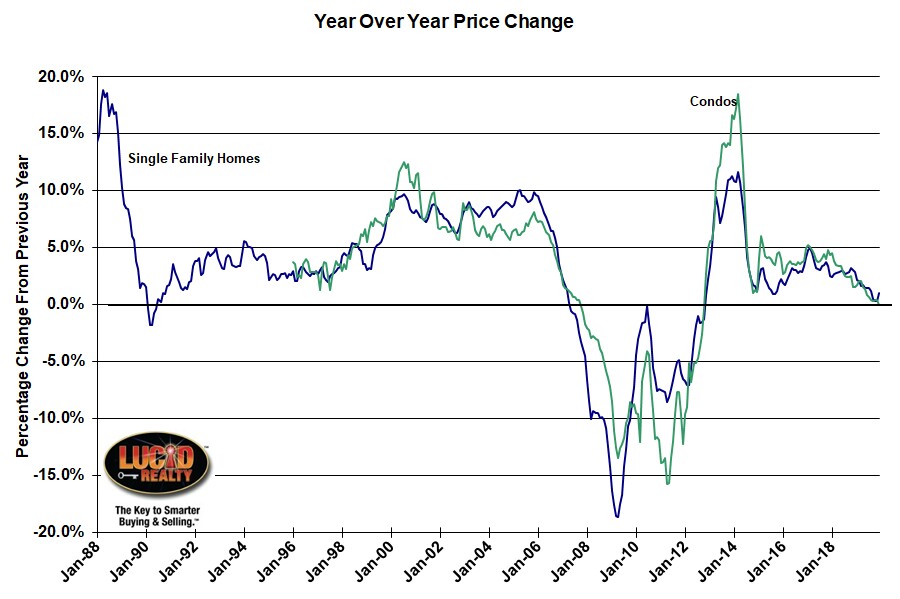

S&P Dow Jones CoreLogic released their December home price data this morning and the Case Shiller Chicago area home price index showed faster appreciation than it did in November. On a year over year basis single family home prices rose by 1.0% vs. 0.3% in November, which was the highest rate in 4 months and also marks the 86th consecutive month of annual gains. The fact that the annual appreciation rate rose is comforting because you can see how it has been trending down in the graph below.

The only problem was that that put the Chicago area at the bottom of the list of 20 metro areas that the Case Shiller index covers. One bit of good news though: we had company at the bottom with New York which also had a mere 1.0% growth rate.

For the 20 largest metro areas they cover the average year over year gain in December was 2.9% vs. 2.5% in November. And if you look across the entire nation home prices rose by 3.8% from the previous December, also an improvement from the 3.5% one year gain in November.

But there is another fly in Chicago’s ointment in that condominium prices were flat to the previous December and that’s the first time that has happened in 86 months. The obvious concern is that they are about to start going negative. It wouldn’t surprise me since this is consistent with the rising inventories and market times of condos that I have been discussing for the last year.

Craig J. Lazzara, Managing Director and Global Head of Index Investment Strategy at S&P Dow Jones Indices, provided some historical and geographical perspective:

This marks eight consecutive years of increasing housing prices (an increase which is echoed in our 10- and 20-City Composites). At the national level, home prices are 59% above the trough reached in February 2012, and 15% above their pre-financial crisis peak. Results for 2019 were broad-based, with gains in every city in our 20-City Composite.

At a regional level, Phoenix retains the top spot for the seventh consecutive month, with a gain of 6.5% for December. Charlotte and Tampa rose by 5.3% and 5.2% respectively, leading the Southeast region. The Southeast has led all regions for the past year.

As was the case last month, after a long period of decelerating price increases, the National, 10-City, and 20-City Composites all rose at a faster rate in December than they had done in November; 12 of our 20 cities likewise saw accelerating prices. It is, of course, too soon to say whether this marks an end to the deceleration or is merely a pause in the longer-term trend.

Case Shiller Chicago Area Home Price Index By Month

The graph below shows the underlying Case Shiller Chicago index numbers by month and you can clearly see the seasonal fluctuations in the values. December is still in the season when prices decline so the single family index actually dropped by 0.1% from November while the condo index fell by 0.9%.

If you compare the graph below to what Craig Lazarra said above you can see that the Chicago real estate market really sucks compared to the rest of the country. Our single family home prices are still 14.7% below the bubble peak and condo prices are 8.4% below the peak while the rest of the country has surpassed those values. To put it in even more stark terms, single family home prices are below the levels they were from July 2004 – October 2008 and condo prices are below the levels from April 2005 – November 2008.

From the ashes of the housing bust single family home prices have recovered by 39.9% and condo prices have bounced back 51.6%, which again pales in comparison to the rest of the nation. But perhaps the saddest part of the Chicago real estate market story is captured in that red trendline in the graph below. I drew it based on home prices before the bubble. Not only are we not catching up to that trendline but we are actually falling further and further behind. Right now we lag it by 28.4%.

#CaseShiller #ChicagoHomePrices #HomePrices

Gary Lucido is the President of Lucid Realty, the Chicago area’s full service real estate brokerage that offers home buyer rebates and discount commissions. If you want to keep up to date on the Chicago real estate market or get an insider’s view of the seamy underbelly of the real estate industry you can Subscribe to Getting Real by Email using the form below. Please be sure to verify your email address when you receive the verification notice.