It’s been almost a month since the Cook County Clerk released the 2017 Cook County and Chicago property tax rates and you’ve probably already received your final 2017 tax bill. I was otherwise occupied at the time so I’m just now getting around to telling you what the numbers mean. In a nutshell it wasn’t as bad as I thought it was going to be.

At the top level Cook County is looking to collect 5.1% more property taxes than for 2016 as is the city of Chicago. However, Chicago Public Schools is taking 8.3% more for 2017. That’s not part of Chicago? Elsewhere in the report they refer to a 6.6% increase in the total taxes billed for Chicago so maybe that includes the school system. As the report explains:

The City of Chicago increased its pension levy approximately $53 million over the 2016 levy. This is the third segment of a planned four-year pension levy increase approved by the City Council beginning in tax year 2015. Additionally, the Chicago Board of Education increased their teachers’ pension levy by approximately $154 million in 2017.

As you will see some of this increase is covered by an increase in the property tax base so that the tax rate doesn’t have to go up by that much. This is why you need growth and gentrification – to feed the monster. Also, commercial and industrial property tax revenue increased by 7.5% in 2017 and that made a huge contribution to the monster.

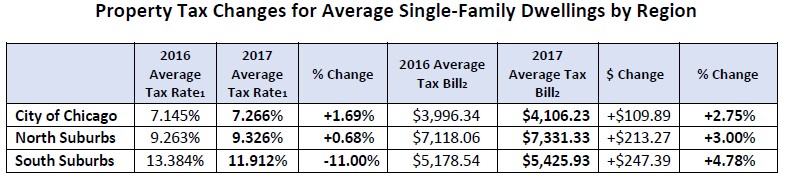

I extracted the table below from the report and it summarizes the changes to the calculation for Chicago and the suburbs. Ignore the first 3 columns because they are kind of meaningless – they only reflect a portion of the calculation. What you are interested in is what is going on in the columns to the right. Note that the average residential tax bill in Chicago is only going up by 2.75%.

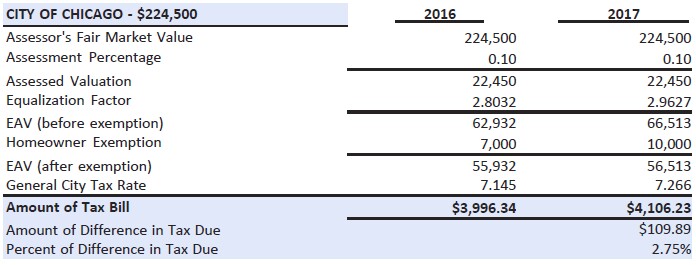

The report also contains this simple example of how property taxes are calculated and you can see from it where the 2.75% increase comes from. Note that the homeowner exemption has been increased to $10,000 from $7,000 so, with the new tax rate, it is now worth approximately $727.

This calculation is a bit more complicated than it needs to be so I basically boil it down to a single percentage. If you back out the homeowner exemption you come up with a $4,832.83 tax bill. That’s 2.15% of the assessor’s fair market value of your property. So basically your property tax is going to be 2.15% of what the assessor thinks your home is worth – $727 for the homeowner exemption.

It’s really important to keep this simpler calculation handy when buying a new property because the actual property taxes are going to be based on the current assessed fair market value, which may be higher or lower than reality. But, as I always tell our buyers, you should pretty much ignore the current property taxes because you can assume that over time if the assessor is too high you will be successful in appealing your valuation or if it’s too low the assessor is going to figure it out and raise your valuation. Instead, use the 2.15% rate against the actual market value and the $727 deduction to figure out what your property taxes are going to be in the long run.

#ChicagoPropertyTaxes #CookCountyPropertyTaxes #PropertyTaxes

Gary Lucido is the President of Lucid Realty, the Chicago area’s full service discount real estate brokerage. If you want to keep up to date on the Chicago real estate market, get an insider’s view of the seamy underbelly of the real estate industry, or you just think he’s the next Kurt Vonnegut you can Subscribe to Getting Real by Email using the form below. Please be sure to verify your email address when you receive the verification notice.